Home

-

Hot News

-

Home

-

Hot News

-

Tesla releases its largest decline in financial report since 2012

Tesla releases its largest decline in financial report since 2012

Author:netwing Time:2024-04-25 Number Of Views:

According to an international e-commerce report, Tesla, the world's largest car manufacturer by market value, released its Q1 2024 financial report, which showed a revenue of $21.301 billion in the first quarter of 2024, lower than the market's generally expected $22.3 billion, a year-on-year decrease of 9%, the largest decline since 2012

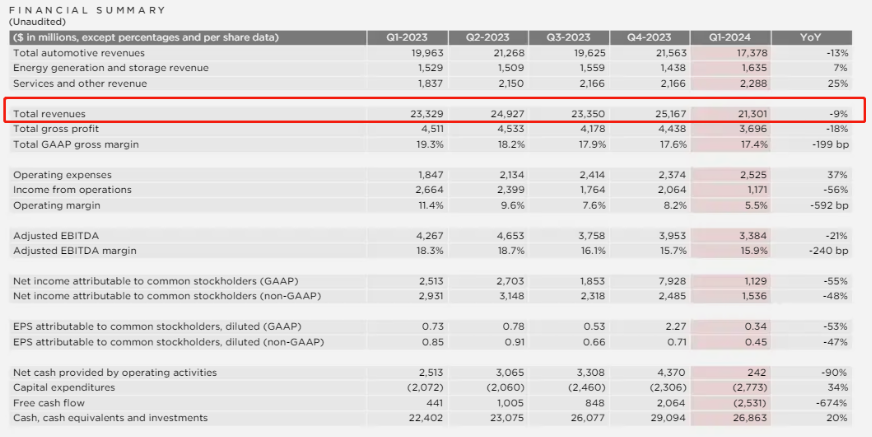

According to an international e-commerce report, Tesla, the world's largest car manufacturer by market value, released its Q1 2024 financial report, which showed a revenue of $21.301 billion, lower than the market's generally expected $22.3 billion, a year-on-year decrease of 9%, the largest decline since 2012. GAAP's net profit was $1.1 billion, lower than the expected $1.81 billion, a decrease of 55% from the previous year. Due to increased inventory and significant capital expenditures on artificial intelligence infrastructure, free cash flow was negative $2.5 billion. In addition, operating cash flow plummeted by 90% year-on-year to $242 million.

According to the report, the year-on-year decline in Tesla's revenue in the first quarter of 2024 was mainly affected by the following factors:

Firstly, due to adjustments in market pricing strategies and changes in product combinations, it is necessary to lower the average selling price of vehicles to adapt to more intense market competition. Although this strategy helps to increase sales, it also puts some pressure on revenue.

Secondly, Tesla's operating expenses have increased this quarter, such as sustained investment in artificial intelligence, cell technology, and other research and development projects. Tesla believes that although the development of these cutting-edge technologies increases operating costs in the short term, they are crucial for the company's long-term development.

In addition, the production of Cybertruck is in its initial stage, and its production cost is relatively high, which has also had a certain impact on its financial data. Meanwhile, due to the Red Sea conflict and production disruptions caused by arson attacks at the Berlin super factory, vehicle deliveries have decreased, further affecting revenue for this quarter.

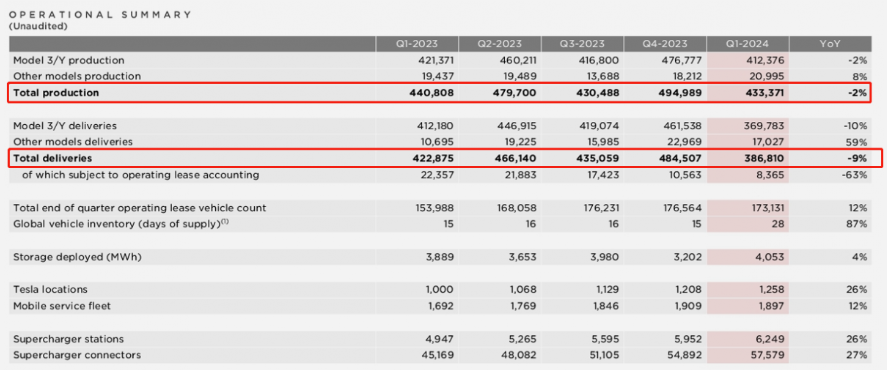

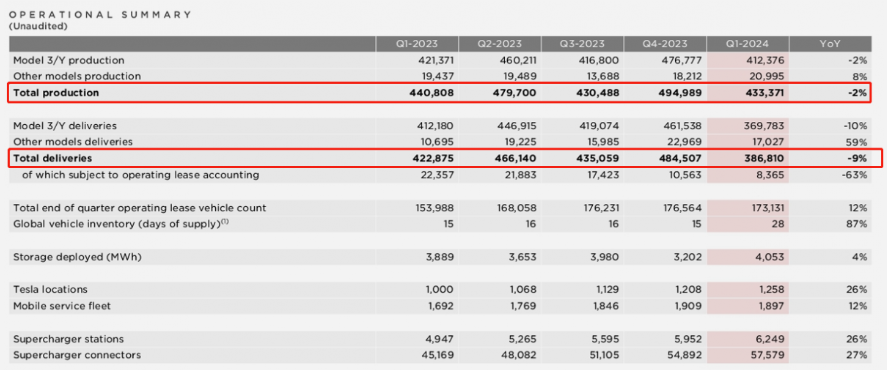

The above chart shows that Tesla delivered 386810 vehicles in the first quarter, a year-on-year decrease of 9%, while production was 433371 vehicles, a year-on-year decrease of 2%. This is the first time that quarterly delivery volume has contracted year-on-year since the impact of the epidemic in the second quarter of 2020.

Tesla announced in its Q4 2023 financial report that its growth rate in 2024 will be "significantly lower" than its growth rate in 2023, as the company continues to prepare for the "next generation" of cars in 2025.

According to Wall Street's consistent forecast for the first quarter of 2024, Tesla's automotive gross profit margin (excluding regulatory points) is expected to be 15.9%. Contrary to these expectations, Tesla's automotive gross profit margin (excluding RC) is 16.36%.

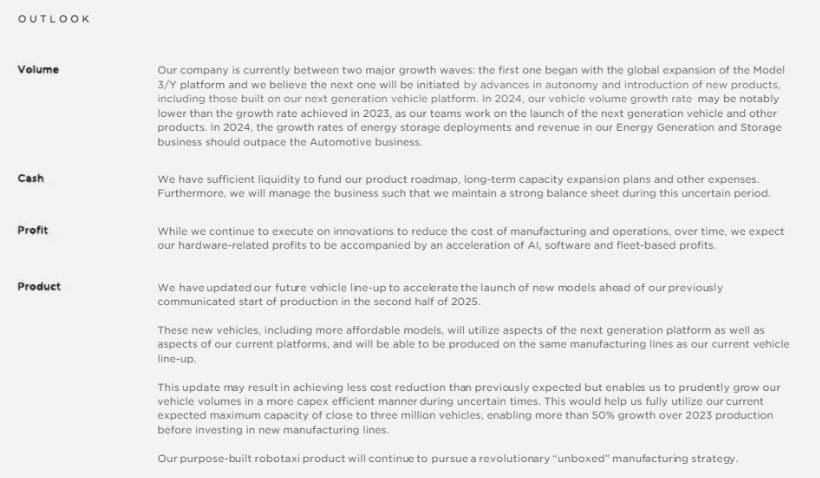

We will actively launch new models

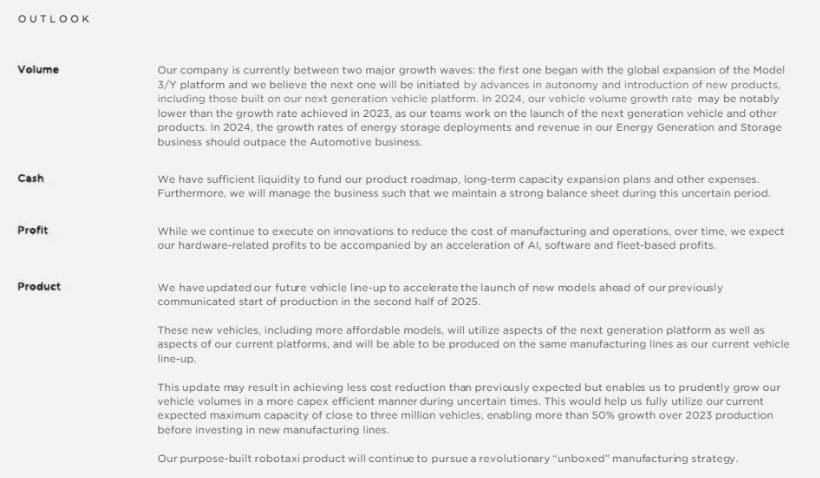

Tesla stated that the company is currently at the intersection of two major growth waves. Firstly, the global expansion of the Model3/Y platform has led the first wave of growth, laying a solid foundation for it and occupying a favorable competitive position in the market. We firmly believe that the next round of growth will be driven by the innovation of autonomous driving technology and the launch of new products (including various products nurtured by its next-generation automotive platform).

Looking ahead to 2024, Tesla expects the growth rate of automotive production to be lower than the level of 2023. This is not because the market demand has decreased, but because its team is fully preparing to launch the next generation of cars and other products. Meanwhile, its energy generation and storage business is also showing strong growth momentum, and it is expected that by 2024, its energy storage deployment and revenue growth rate will exceed that of its automotive business.

In terms of cash flow, Tesla has sufficient working capital to support its product roadmap, long-term capacity expansion plan, and other expenses.

In terms of profits, we will continue to promote innovation to reduce manufacturing and operating costs. If continuous efforts are made to optimize the cost structure and successfully reduce the cost of each vehicle, including raw material costs, freight, and tariffs, these measures will help improve the overall profitability level. In addition, Tesla believes that hardware related profits will accelerate growth in sync with artificial intelligence, software, and fleet based profits.

In terms of products, Tesla has updated its future car lineup, and the launch time of these new models will be earlier than the previously announced second half of 2025. These new models will fully utilize their next-generation platform and various technological advantages of the current platform, and can be produced on the same production line as our existing car lineup, achieving a production target of more than 50% growth compared to 2023.

Can Musk regain $56 billion in salary?

As early as 2018, Tesla awarded Elon Musk a compensation package worth approximately $56 billion, which is one of the largest compensation packages in American corporate history.

However, in 2022, Tesla will face a legal dispute. Some shareholders claimed that Musk's 2018 compensation plan was a product of false negotiations and should therefore be considered invalid. They submitted the matter to the Delaware Court of Equity for a ruling.

In the end, the Chief Justice of the court, Kathaleen St. J. McCormick, made a ruling in favor of the plaintiff, ruling that Musk's 2018 compensation plan was invalid.

Regarding this, Musk stated that due to his current ownership of approximately 13% of Tesla's voting rights, he feels uncomfortable working in Tesla's environment.

Prior to the upcoming Annual General Meeting (AGM), Tesla's board of directors had issued a preliminary delegation statement calling on all shareholders to approve Elon Musk's 2018 compensation plan once again.

In addition, Tesla is currently conducting large-scale layoffs worldwide, with layoffs exceeding 10%, and some departments may even experience layoffs of up to 20%.

According to statistics, the median salary of Tesla's non CEO employees in 2023 is approximately $34000. Assuming Tesla lays off 15000 employees, the company can save approximately $500 million in costs annually.

This article is reproduced in the International E-commerce Information. If there is any infringement, please contact us to delete it

Contact Us:0755-82760106

Contact Us:0755-82760106 Proposal:0755-83260671

Proposal:0755-83260671 Mailbox:jessie@ruizhengwei.com

Mailbox:jessie@ruizhengwei.com Address:18F, Building A, Rongde International, Henggang Street, Longgang District, Shenzhen City, Guangdong Province

Address:18F, Building A, Rongde International, Henggang Street, Longgang District, Shenzhen City, Guangdong Province